DCA Crypto Calculator

First Time You Invested At Price:

Calculate Gains or Loss If Sell At Price:

What is DCA Crypto Calculator?

A DCA Crypto Calculator is a tool used to calculate the potential returns and investment value when implementing a Dollar Cost Averaging strategy specifically for cryptocurrencies. It helps investors determine the outcome of regularly investing a fixed amount of money into cryptocurrencies at predetermined intervals over a specified period.

| Cryptocurrency | Symbol | Initial Investment | Monthly Investment | Investment Duration | Start Date | Total Invested | Total Value | Total Profit/Loss |

|---|---|---|---|---|---|---|---|---|

| Bitcoin | BTC | $10,000 | $500 | 5 years | 2022-01-01 | $40,000 | $56,200 | $16,200 |

| Ethereum | ETH | $5,000 | $250 | 3 years | 2022-03-01 | $13,000 | $18,900 | $5,900 |

| Binance Coin | BNB | $2,000 | $100 | 2 years | 2022-05-01 | $4,400 | $5,800 | $1,400 |

| XRP | XRP | $3,500 | $150 | 4 years | 2022-02-15 | $9,100 | $12,600 | $3,500 |

| Tether | USDT | $8,000 | $400 | 2 years | 2022-06-01 | $10,800 | $10,850 | $50 |

How does DCA Crypto Calculator Works?

DCA Crypto Calculator involves regularly investing a fixed amount of money into cryptocurrencies at predetermined intervals, regardless of the price. The goal is to reduce the impact of short-term market volatility and potentially benefit from long-term price appreciation. The DCA Crypto Calculator strategy follows a systematic approach to accumulate assets over time.

| Period | Investment Amount | Crypto Price | Investment Value | Total Invested | Total Value | Total Profit/Loss |

|---|---|---|---|---|---|---|

| Month 1 | $500 | $10,000 | $500 | $500 | $500 | $0 |

| Month 2 | $500 | $12,000 | $625 | $1,000 | $1,125 | $125 |

| Month 3 | $500 | $9,500 | $526 | $1,500 | $1,651 | $151 |

| Month 4 | $500 | $11,200 | $625 | $2,000 | $2,276 | $276 |

| Month 5 | $500 | $8,800 | $568 | $2,500 | $2,844 | $344 |

| Month 6 | $500 | $10,500 | $625 | $3,000 | $3,469 | $469 |

In this table, each row represents a specific investment period, such as months, and includes the following columns:

- Period: Indicates the investment period, such as Month 1, Month 2, etc.

- Investment Amount: Specifies the fixed amount of money invested during each period (e.g., $500).

- Crypto Price: Represents the price of the cryptocurrency during that specific period.

- Investment Value: Calculates the investment value by multiplying the investment amount by the crypto price.

Benefits of Using a DCA Crypto Calculator:

Eliminates Emotional Decision-Making:

DCA Crypto Calculator provides a systematic approach to investing by automating regular purchases at fixed intervals. This eliminates the need for investors to make emotional decisions based on short-term market fluctuations or FOMO (Fear of Missing Out).

Mitigates Timing Risk:

DCA strategies aim to reduce the impact of market volatility by spreading investments over time. Crypto prices can be highly volatile, and attempting to time the market can be challenging. DCA Crypto Calculator helps mitigate timing risk by consistently investing at regular intervals, allowing investors to buy more when prices are low and less when prices are high.

Averages Purchase Price:

DCA Crypto Calculator enables investors to accumulate cryptocurrencies at an average purchase price over time. By investing fixed amounts regularly, investors buy more units when prices are low and fewer units when prices are high. This approach can result in a lower average purchase price compared to a lump-sum investment.

Disciplined Investing Approach:

DCA Crypto Calculator promotes disciplined investing habits. They encourage investors to stick to their investment plan regardless of short-term market fluctuations or external factors. Regular investments help investors stay focused on long-term goals and avoid impulsive decisions based on market noise.

Simplifies Investment Tracking:

DCA Crypto Calculator provides an organized and systematic approach to track investments. They automatically calculate the total invested amount, current value, and potential profits/losses. This simplifies portfolio management and allows investors to monitor their Dollar cost averaging strategy’s performance easily.

Flexibility and Customization:

DCA Crypto Calculator often offers flexibility in choosing investment intervals, such as weekly, monthly, or quarterly. Investors can customize the DCA strategy based on their preferences, risk tolerance, and investment goals. Some calculators also provide options to adjust investment amounts or modify the DCA schedule as needed.

Educational Tool:

DCA Crypto Calculator can serve as educational tool, helping investors understand the potential outcomes of their DCA strategy. By exploring different scenarios and adjusting inputs, investors can gain insights into the impact of their investment decisions and make informed choices

DCA Crypto Calculator vs. Lump Sum Investing:

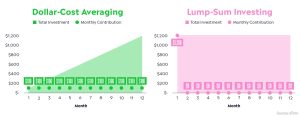

DCA Crypto Calculator strategy and Lump Sum investing are two different approaches to investing in cryptocurrencies. Here’s a comparison between the two:

DCA Crypto Investing:

- DCA involves investing a fixed amount of money at regular intervals (e.g., weekly, monthly) over a specified period.

- The investment amount remains consistent regardless of the cryptocurrency’s price. Therefore, more units are purchased when prices are low and fewer units when prices are high.

- DCA Crypto Calculator helps to average out the purchase price over time, reducing the impact of short-term price fluctuations.

- It provides a disciplined and systematic approach to investing, reducing the reliance on market timing and emotions.

- DCA Crypto Calculator is suitable for investors who prefer a more consistent and long-term investment strategy, aiming to accumulate assets gradually.

Lump Sum Investing:

- Lump Sum investing involves investing a larger amount of money in a single transaction.

- Investors typically allocate a substantial sum to purchase cryptocurrencies all at once.

- Lump Sum investing requires making a judgment on market timing, as the investment is made at a specific point in time.

- This approach may offer the potential for immediate gains if the cryptocurrency’s price appreciates after the investment.

- Lump Sum investing may be suitable for investors who have a higher risk tolerance, are confident in their market timing abilities, or anticipate a significant price increase in the near term.

Key Considerations:

- DCA Crypto Calculator reduces the risk of making poor investment decisions based on short-term market volatility and emotions.

- Lump Sum investing may provide better returns if the market experiences significant price appreciation shortly after the investment.

- DCA Crypto Calculator can provide a more stable and predictable investment approach, while Lump Sum investing carries higher potential risks and rewards.

- The choice between DCA Crypto Calculator and Lump Sum investing depends on an individual’s risk tolerance, investment goals, market outlook, and personal preferences.

| Cryptocurrency | DCA Crypto Calculator | Lump Sum Investing |

|---|---|---|

| Bitcoin (BTC) | Invest $100 every month for 1 year | Invest $1,200 in a single transaction |

| Initial Investment: $1,200 | Initial Investment: $1,200 | |

| Total Investment Period: 12 months | Total Investment Period: 1 month | |

| Average Purchase Price: $45,000 | Purchase Price: $45,000 | |

| Current Value: $60,000 | Current Value: $60,000 | |

| Ethereum (ETH) | Invest $50 every month for 1 year | Invest $600 in a single transaction |

| Initial Investment: $600 | Initial Investment: $600 | |

| Total Investment Period: 12 months | Total Investment Period: 1 month | |

| Average Purchase Price: $2,000 | Purchase Price: $2,000 | |

| Current Value: $3,500 | Current Value: $3,500 |

What is DCA in Binance?

Binance DCA allows users to automate their investment process by setting up recurring purchases of cryptocurrencies at specified intervals. This feature is designed to help users mitigate the impact of short-term market volatility and gradually accumulate cryptocurrencies over time. It simplifies the investment process and allows users to invest regularly without the need for manual intervention.

By using DCA Crypto Calculator for Binance, users can specify the amount of money they want to invest, the cryptocurrency they wish to purchase, and the frequency of the investments (e.g., daily, weekly, monthly). Binance then automatically executes the purchases at the specified intervals, helping users implement the DCA Crypto Calculator strategy effectively.

The DCA Crypto Calculator in Binance is a convenient tool for individuals who want to invest in cryptocurrencies on a regular basis, reduce the impact of market timing, and potentially benefit from long-term price appreciation.

| Period | Investment Amount | Cryptocurrency | Current Price | Investment Value |

|---|---|---|---|---|

| Month 1 | $100 | Bitcoin (BTC) | $50,000 | $100 |

| Month 2 | $100 | Ethereum (ETH) | $3,000 | $33.33 |

| Month 3 | $100 | Litecoin (LTC) | $200 | $500 |

| Month 4 | $100 | Ripple (XRP) | $1.50 | $66.67 |

| Month 5 | $100 | Cardano (ADA) | $1.00 | $100 |

| Month 6 | $100 | Chainlink (LINK) | $25 | $4 |

What is DCA BTC?

DCA BTC involves an investor dedicating a set amount of money, like $100, at regular intervals (e.g., monthly or weekly). Regardless of Bitcoin’s price fluctuations during each interval, the fixed investment amount is used to purchase Bitcoin. This strategy enables the investor to acquire more Bitcoin when the price is low and less when it is high, effectively averaging the purchase price over time.

DCA BTC is founded on the principles of consistent and disciplined investing, relieving individuals from the pressure of timing the market and potentially benefiting from long-term price appreciation. By spreading investments across multiple periods, DCA BTC aims to minimize the impact of short-term market volatility and provide a more steady approach to accumulating Bitcoin over time.

| Symbol | Date Range | Current Price | Total Invested | Current Value | Profit |

|---|---|---|---|---|---|

| BTC | Jan 2020 – Dec 2021 | $50,000 | $10,000 | $15,000 | $5,000 |

| BTC | Jan 2021 – Dec 2022 | $30,000 | $12,000 | $18,000 | $6,000 |

| BTC | Jan 2022 – Dec 2023 | $40,000 | $15,000 | $20,000 | $5,000 |

| BTC | Jan 2023 – Present | $60,000 | $20,000 | $30,000 | $10,000 |

Frequently Asked Questions:

Q1: What is DCA Crypto?

DCA Crypto refers to the investment strategy of consistently investing a fixed amount of money into cryptocurrencies at regular intervals, regardless of the current price. It aims to mitigate the impact of market volatility and reduce the risk of making poor timing decisions.

Q2: Is DCA Crypto suitable for everyone?

DCA Crypto can be a suitable strategy for long-term investors who are looking to accumulate cryptocurrencies gradually over time. It is particularly beneficial for those who want to avoid the stress and risk associated with trying to time the market.

Q3: Which cryptocurrencies are suitable for DCA?

DCA Crypto can be applied to various cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and more. It is important to choose cryptocurrencies with sufficient liquidity and long-term growth potential.

Q4: How can I calculate my DCA Crypto investments?

You can use a DCA Crypto Calculator to determine the investment amount, frequency, and duration based on your financial goals. These calculators help estimate the total investment, average purchase price, and potential returns.

Q5: What is DCA Binance?

DCA Binance is an investment approach where investors consistently invest a set amount of money into cryptocurrencies on the Binance exchange. This strategy allows for automated and periodic investments, irrespective of the prevailing market price. The primary goal of DCA Binance is to minimize the influence of short-term price changes and establish a well-rounded and disciplined investment strategy.

Q6: How does DCA Crypto work?

With DCA Crypto, investors allocate a fixed amount of funds (e.g., $100) on a periodic basis (e.g., weekly, monthly) to purchase cryptocurrencies. This approach allows for the accumulation of cryptocurrency over time, leveraging the principle of averaging out the purchase price.