Is QYLD a Good Investment: Guide (2023)

What is the Global X Nasdaq 100 Covered Call ETF QYLD?

QYLD is an exchange-traded fund (ETF) that seeks to provide investment results corresponding to the performance of the CBOE Nasdaq-100 BuyWrite V2 Index. The fund utilizes a covered call strategy, which involves holding a portfolio of stocks from the Nasdaq-100 Index while simultaneously selling or writing call options on a portion of those holdings. This strategy generates income through the premiums received from selling the call options.

How does QYLD works?

By selling call options, QYLD collects premiums, which can provide investors with regular income in the form of dividends. The covered call strategy aims to capitalize on the potential for stock prices to remain relatively stable or experience modest gains, allowing the ETF to benefit from the income generated by selling call options. For more understanding, visit this article about QYLD to get more insight into it.

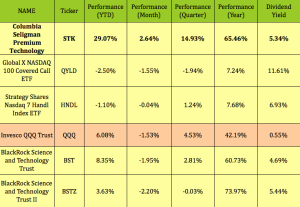

Comparison with QQQ:

The Invesco QQQ Trust (QQQ) is another popular ETF that tracks the performance of the Nasdaq-100 Index. While both QYLD and QQQ are linked to the same index, they employ different investment strategies. QQQ aims to replicate the index’s performance, providing investors with exposure to the top 100 non-financial companies listed on the Nasdaq. In contrast, QYLD focuses on generating income through the covered call strategy.

Evaluating QYLD as an Investment:

QYLD dividend yield and dividend history

When considering an investment, one important aspect to assess is the dividend yield. QYLD has historically offered a relatively high dividend yield due to the income generated by the covered call strategy. However, it’s crucial to note that dividend yields can fluctuate over time, influenced by market conditions and changes in the underlying stocks.

Potential risks associated with QYLD

While QYLD may provide attractive income potential, it’s essential to consider the associated risks. The covered call strategy employed by QYLD limits potential capital gains in exchange for the income generated from selling call options. During periods of significant market growth, the ETF’s performance may lag behind the broader market, such as during bull markets.

Long-term outlook and considerations

When evaluating QYLD as a long-term investment, it’s important to consider individual financial goals, risk tolerance, and investment time horizon. While the ETF offers income potential, investors should carefully assess whether the strategy aligns with their investment objectives. It’s advisable to consult with a financial advisor to evaluate the suitability of QYLD based on personal circumstances.

Why QYLD Is Not A Good Investment:

Personal perspective and reasoning

While QYLD may have its merits, it’s crucial to provide a balanced view by sharing personal perspectives on the investment. As an investor, I have reservations about QYLD as a long-term investment option. The covered call strategy limits potential capital appreciation, which can hinder overall portfolio growth. Additionally, the ETF’s performance may underperform during periods of significant market expansion.

Alternative investment options

For investors seeking alternative options, several strategies and ETFs can provide exposure to the stock market while aiming for long-term growth. Some examples include low-cost index funds that track broad market indices or actively managed funds that focus on specific sectors or themes. It’s essential to conduct thorough research and consider individual investment objectives when exploring alternatives to QYLD.

Conclusion:

In conclusion, the decision of whether QYLD is a good investment ultimately depends on individual circumstances and investment goals. While QYLD offers an attractive dividend yield and employs a unique covered call strategy, it’s crucial to carefully evaluate its long-term potential, associated risks, and alignment with personal investment objectives. As with any investment, it’s advisable to conduct thorough research, seek professional advice, and diversify portfolios to minimize risk and optimize long-term growth.

FAQs

Q1: Is QYLD a good investment for long-term growth?

The suitability of QYLD for long-term growth depends on individual financial goals and risk tolerance. It’s important to assess whether the covered call strategy aligns with your investment objectives.

Q2: How does QYLD compare to QQQ?

QYLD and QQQ are both ETFs linked to the Nasdaq-100 Index but employ different investment strategies. QYLD focuses on generating income through covered call options, while QQQ aims to replicate the index’s performance.

Q3: What is the dividend yield and dividend history of QYLD?

QYLD has historically offered a relatively high dividend yield due to the income generated from the covered call strategy. However, dividend yields can fluctuate over time.

Q4: What are the risks involved in investing in QYLD?

Risks associated with QYLD include potential limitations on capital gains due to the covered call strategy and underperformance during periods of significant market expansion.

Q5: Are there any alternative investment options to consider?

Alternative investment options include low-cost index funds and actively managed funds that provide exposure to the stock market while aiming for long-term growth. Research and consultation with a financial advisor are recommended to explore suitable alternatives to QYLD.