Pros and Cons of Dollar Cost Averaging (2023)

Introduction:

Dollar Cost Averaging (DCA) is an investment strategy that involves regularly investing a fixed amount of money in a particular asset, regardless of its current price. The primary goal of DCA is to lower the average cost per share or unit over time. This approach is often employed by long-term investors to mitigate the impact of market volatility and avoid making emotional decisions based on short-term price fluctuations.

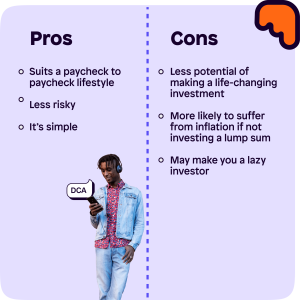

Pros of Dollar Cost Averaging:

Lowering the Average Cost

By consistently investing a fixed amount, investors automatically buy more units or shares when the prices are low and fewer when the prices are high. As a result, the average cost per unit decreases over time, potentially leading to better overall returns in the long run.

Mitigating Market Volatility

DCA helps in reducing the impact of market volatility on investments. Instead of investing a lump sum amount at a single point in time, spreading investments over regular intervals can smoothen the effect of market fluctuations.

Reducing Emotional Decision Making

Investing can be emotionally charged, especially during times of market turbulence. DCA encourages a disciplined approach, removing the need for investors to time the market, which often leads to hasty decisions driven by fear or greed.

Suitable for Long-Term Investors

DCA aligns well with the objectives of long-term investors who seek to build wealth over an extended period. It allows them to participate in the market consistently without trying to predict short-term price movements.

Automatic Investment Process

Implementing a DCA strategy is relatively straightforward. Through automated processes, investors can set up regular contributions to their investment accounts, making it a convenient and hassle-free approach.

Cons of Dollar Cost Averaging:

Potential to Miss Out on Market Upswings

While DCA helps in avoiding significant losses during market downturns, it might cause investors to miss out on potential gains during upward market trends. This is because the fixed investment amount may not be sufficient to capitalize fully on rising asset prices.

Not Ideal for Lump Sum Investors

For individuals with a considerable sum of money to invest, DCA might not be the most optimal strategy. In such cases, a lump sum investment might yield better results, especially in bull markets.

Impact of Transaction Costs

Frequent investments through DCA could lead to higher transaction costs, particularly for assets with significant trading fees. These costs can eat into overall returns, affecting the effectiveness of the strategy.

Possible Underperformance in Bull Markets

In extended periods of bullish market conditions, DCA may result in underperformance compared to a lump sum investment. This is because the continuous inflow of funds may not keep pace with rapidly rising asset prices.

The Risk of Accumulating Underperforming Assets

If an investor employs DCA with an underperforming asset, the strategy may not offset the poor performance effectively. In such cases, it might be better to reassess the investment and consider alternative options.

Key Considerations for Dollar Cost Averaging:

Investment Time Horizon

Before adopting DCA, it is essential to determine the investment time horizon. This strategy is better suited for long-term goals where the benefits of cost averaging can be fully realized.

Risk Tolerance

Investors should assess their risk tolerance and comfort with market fluctuations. DCA may help reduce the emotional toll of investing, but it still exposes investors to market risks.

Diversification Strategy

DCA works well when coupled with a diversified investment portfolio. Spreading investments across different assets can further reduce risk and improve overall performance.

Why Might Someone Consider Dollar Cost Averaging?

Dollar Cost Averaging can be an attractive strategy for several reasons:

- Risk Management: DCA helps manage risk by spreading investments over time, reducing the impact of market volatility.

- Simplicity: It offers a straightforward investment approach suitable for both beginners and experienced investors.

- Emotional Control: DCA reduces emotional decision-making, promoting a disciplined investment approach.

Tips for Effective Dollar Cost Averaging:

To make the most of Dollar Cost Averaging, consider the following tips:

- Stay Consistent: Stick to your investment schedule to benefit from the advantages of regular investing.

- Diversify Your Portfolio: Spread your investments across different assets to minimize risk.

- Review Your Strategy Periodically: Assess your investment performance and adjust your strategy if needed.

What Are the Potential Downsides of Dollar Cost Averaging?

Dollar Cost Averaging has some potential downsides to be aware of:

- Limited Upside Potential: DCA may limit potential gains during bull markets, as you may not fully capitalize on rapid price increases.

- Opportunity Cost: Regular fixed investments may tie up funds that could be used elsewhere for potentially higher returns.

- Market Timing Risk: DCA does not eliminate market timing risk entirely, as it assumes a stable income stream.

Conclusion:

In conclusion, dollar cost averaging offers several advantages, making it a popular choice among long-term investors seeking to build wealth steadily. It helps mitigate the impact of market volatility, discourages emotional decision making, and simplifies the investment process. However, it’s important to recognize its limitations, such as potentially missing out on market upswings and transaction costs. Each investor’s unique financial situation and risk profile should be considered before adopting the DCA strategy.

Frequently Asked Questions:

Q1: Is dollar cost averaging suitable for short-term investments?

Dollar cost averaging is best suited for long-term investments due to its focus on reducing average costs over time.

Q2: Does dollar cost averaging guarantee profits?

No investment strategy can guarantee profits. DCA is a risk management tool rather than a profit guarantee.

Q3: Can I use dollar cost averaging with individual stocks?

Yes, DCA can be applied to individual stocks, ETFs, mutual funds, and other investment vehicles.

Q4:What is the ideal investment frequency for dollar cost averaging?

The investment frequency can vary based on individual preferences, but regular monthly investments are common.

Q5:Can dollar cost averaging be combined with other investment strategies?

Yes, investors often use DCA alongside other strategies, such as value averaging or tactical asset allocation, to create a comprehensive approach to investing.