How To Use Dollar Cost Averaging for Automated Investing (2023)

Introduction:

In the world of investing, finding a strategy that balances risk and reward can be a daunting task. Dollar Cost Averaging (DCA) is a proven investment approach that allows individuals to accumulate wealth gradually over time. By automating the DCA process, investors can simplify their investment journey and harness the power of compounding returns. In this comprehensive guide, we will explore the benefits of automating DCA, how to implement it effectively, and answer common questions to help you make informed investment decisions.

Understanding Dollar Cost Averaging:

Dollar Cost Averaging, also known as a constant dollar plan, is an investment strategy that involves regularly investing a fixed amount of money into a particular asset or portfolio, regardless of its price. This approach aims to mitigate the impact of short-term market volatility by buying more shares when prices are low and fewer shares when prices are high. Over time, this can result in a lower average cost per share and potential long-term gains.

Benefits of Automating DCA:

- Consistency and Discipline: By automating DCA, you eliminate the need for manual decision-making and emotional reactions to market fluctuations. This ensures a consistent investment approach, helping you stay disciplined and avoid making impulsive investment choices based on short-term market movements.

- Time-Saving: Automating DCA frees up your time from continuously monitoring the market and executing trades. Once you set up the automated process, your investments will be made automatically, allowing you to focus on other aspects of your life while still growing your wealth.

- Mitigating Timing Risks: Timing the market is notoriously difficult, even for experienced investors. Automating DCA eliminates the need to predict market highs or lows, as fixed investments are made regularly regardless of market conditions. This reduces the risk of making poor timing decisions that could negatively impact your returns.

Implementing Automated DCA:

- Choose a Suitable Investment Platform: To automate DCA, you need a reliable investment platform or brokerage that offers automated investment options. Research and select a platform that aligns with your investment goals, fees, and the assets you wish to invest in.

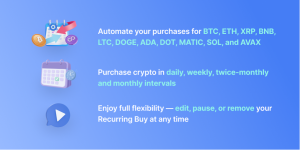

- Select the Investment Frequency: Determine the frequency at which you want to invest. Common options include monthly, bi-monthly, or quarterly investments. Consider your financial goals, cash flow, and the investment platform’s fee structure when choosing the frequency.

- Set the Investment Amount: Decide on the fixed amount you want to invest regularly. Ensure this amount is comfortably affordable and aligns with your overall financial plan. It’s important to stay consistent with this amount to fully benefit from DCA.

- Choose the Investment Vehicle: Select the specific assets or funds you want to invest in. This can include low-cost index funds like S&P 500 index funds and exchange-traded funds (ETFs), or any other diversified investments such as mutual bonds, stocks, and funds that align with your risk tolerance and long-term objectives.

If you’re part of a 401(k) plan with your employer, chances are you’re already making the most of automatic investing. These plans make it easy by deducting a portion of your paycheck and depositing it straight into your retirement account, often with extra contributions from your employer. When you sign up for the 401(k), you get to choose your investment strategy, and from that point onwards, your investments pretty much run on autopilot. It’s a convenient and hassle-free way to secure your financial future.

Frequently Asked Questions

Q1: Is Dollar Cost Averaging suitable for all investors?

Yes, DCA is a versatile investment strategy suitable for both novice and experienced investors. Its systematic nature helps reduce the impact of market volatility, making it an attractive option for long-term wealth accumulation.

Q2: Can I automate DCA with any investment platform?

Not all investment platforms offer automated DCA features. Before choosing a platform, ensure it provides this functionality or explore third-party services that integrate with your preferred platform.

Q3: How does automated DCA compare to lump-sum investing?

While lump-sum investing involves investing a large sum of money at once, automated DCA spreads investments over time. DCA can help mitigate the risk of investing a lump sum at a market peak, but both approaches have their pros and cons. Consider your financial situation and risk tolerance when deciding which method suits you best.

Conclusion

Automating Dollar Cost Averaging can provide individuals with a simple and effective investment strategy for long-term wealth accumulation. By eliminating emotional decision-making and benefiting from the power of compounding returns, automating DCA allows investors to stay consistent, save time, and mitigate timing risks. As with any investment strategy, it’s important to do thorough research, choose a reliable investment platform, and stay committed to your financial goals. Start automating your DCA today and enjoy the benefits of a well-executed investment plan.