Evolutionary Dynamics Of The Cryptocurrency Market (2023)

Introduction:

The world of finance has undergone a significant transformation with the emergence of cryptocurrencies and the subsequent rise of the crypto market. Cryptocurrencies, such as Bitcoin, Ethereum, and many others, have captured the attention of investors and enthusiasts worldwide. In this article, we will explore the dynamics of the crypto market, including its historical overview, key factors influencing its dynamics, market participants, the role of technology, market cycles, indicators, global impact, risks and challenges, and future opportunities.

Historical Overview of the Crypto Market:

The crypto market’s story began in 2009 with the launch of Bitcoin, the first decentralized cryptocurrency. Created by an anonymous individual or group known as Satoshi Nakamoto, Bitcoin introduced the concept of blockchain technology. Over the years, the crypto market has witnessed exponential growth and evolution, with thousands of cryptocurrencies now available in the market.

Key Factors Influencing Crypto Market Dynamics:

Several factors play a crucial role in shaping the dynamics of the crypto market. Firstly, supply and demand dynamics heavily impact the prices of cryptocurrencies. Limited supply and increasing demand often lead to price appreciation, while oversupply and decreasing demand can result in price depreciation. Secondly, the regulatory environment significantly influences market sentiment and investor confidence. Regulatory developments and government policies can either foster or hinder the growth of the crypto market. Additionally, investor sentiment and market volatility, which are inherent in the crypto market, contribute to its dynamics.

Market Participants in the Crypto Market:

The crypto market attracts various types of participants. Retail investors, individual traders, and enthusiasts constitute a significant portion of the market. These individuals often engage in trading, holding, and using cryptocurrencies for various purposes. Institutional investors, such as hedge funds, asset management firms, and even corporations, have also started entering the crypto market, bringing increased liquidity and legitimacy. Miners and validators play a critical role in maintaining the integrity and security of the underlying blockchain networks.

Evolutionary dynamics of the cryptocurrency market:

At the core of the crypto market lies blockchain technology, a decentralized and immutable ledger that records transactions. Blockchain ensures transparency, security, and trust in the crypto market. Smart contracts, programmable agreements executed on the blockchain, enable the automation of various processes. Moreover, the emergence of decentralized finance (DeFi) has opened up new avenues for lending, borrowing, and other financial services, transforming traditional financial systems. For more insight, visit this article about the evolutionary dynamics of the cryptocurrency market.

Crypto Market Cycles and Trends:

The crypto market is known for its cycles of booms and busts. Bull markets, characterized by upward price trends and optimism, often attract a surge of new investors. However, these bull markets are often followed by bear markets, marked by price declines and pessimism. Understanding market cycles and their impact is crucial for navigating the crypto market effectively and making informed investment decisions.

Understanding Crypto Market Indicators:

Several key indicators provide insights into the crypto market’s health and performance. Market capitalization, the total value of all cryptocurrencies combined, gives an overview of the market’s size. Trading volume, the total amount of cryptocurrencies traded within a specific period, indicates market liquidity and activity. Monitoring price trends and patterns, such as support and resistance levels, can help identify potential buying or selling opportunities.

The Global Impact of Crypto Market Dynamics:

The dynamics of the crypto market extend beyond financial markets. The increasing adoption of cryptocurrencies has significant economic implications. It offers individuals and businesses access to alternative financial systems and enables cross-border transactions with reduced fees and faster settlement times. Furthermore, cryptocurrencies promote financial inclusion by providing access to financial services for the unbanked and underbanked populations. Geopolitically, the rise of cryptocurrencies and blockchain technology has sparked discussions on the potential disruption of traditional financial systems and the balance of power.

Crypto Market Dynamics In Stressful Conditions:

While the crypto market presents numerous opportunities, it also carries inherent risks and challenges. Security risks, including hacking, phishing, and scams, pose a constant threat to investors and the overall market. Regulatory uncertainties, varying from country to country, create a challenging landscape for market participants. Market manipulation, such as pump-and-dump schemes, can distort prices and mislead investors. Understanding these risks is crucial for safeguarding investments and promoting a more robust and secure crypto market.

Entry And Exit Dynamics Of The Cryptocurrency Market:

Looking ahead, the crypto market shows immense potential for further growth and innovation. Increasing adoption of cryptocurrencies by individuals, businesses, and even governments may lead to a more widespread use of digital assets. Integration with traditional financial systems, such as the development of central bank digital currencies (CBDCs) and the interoperability of blockchain networks, can foster a more seamless and inclusive financial ecosystem. Areas like decentralized finance (DeFi), non-fungible tokens (NFTs), and blockchain-based supply chain solutions present exciting opportunities for future development and disruption.

Elements of the Cryptocurrency Ecology:

The cryptocurrency ecology comprises several key elements. Firstly, cryptocurrencies themselves serve as digital assets, often based on blockchain technology. Blockchain, as the underlying infrastructure, enables secure and transparent transactions, forming the backbone of the cryptocurrency ecosystem. Miners and validators play a crucial role in maintaining the integrity and security of the blockchain network. Additionally, exchanges and wallets provide platforms for users to trade, store, and manage their cryptocurrencies.

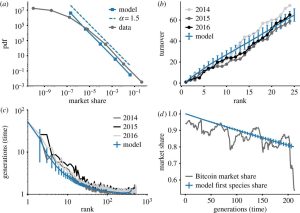

- The exponent of the market share distribution (figure 5a)

- The linear behavior of the turnover profile of the dominant cryptocurrencies (figure 5b)

- The average occupancy time of any given rank (figure 5c)

- The linear decrease of the dominant cryptocurrency (figure 5d)

Interactions within the Cryptocurrency Ecology:

The cryptocurrency ecology involves various interactions among its components. Transactional interactions occur when users send and receive cryptocurrencies, facilitated by the blockchain’s decentralized network. The mining and validation process, conducted by miners and validators, involves solving complex mathematical problems to secure the blockchain network and validate transactions. Trading and investment activities take place on cryptocurrency exchanges, where users can buy, sell, or trade cryptocurrencies based on market demand and price fluctuations.

Factors Influencing the Cryptocurrency Ecology:

Several factors influence the dynamics of the cryptocurrency ecology. Market demand and adoption play a significant role in determining the value and popularity of cryptocurrencies. As more individuals and businesses embrace cryptocurrencies for various purposes, their utility and acceptance grow. The regulatory environment also plays a crucial role, as governments and regulatory bodies develop frameworks to govern the use of cryptocurrencies and ensure consumer protection. Technological advancements, such as scalability solutions and improved security measures, shape the evolution of the cryptocurrency ecosystem.

Challenges and Opportunities in the Cryptocurrency Ecology:

The cryptocurrency ecology faces both challenges and opportunities. Security and scalability challenges are prevalent due to the decentralized nature of blockchain networks. Ensuring the protection of digital assets and addressing scalability concerns are crucial for the widespread adoption of cryptocurrencies. However, cryptocurrencies also present opportunities for financial inclusion, allowing individuals without access to traditional banking systems to participate in the global economy. Moreover, the cryptocurrency ecosystem fosters innovation and decentralization, enabling individuals to take control of their finances and explore new economic models.

The Future of the Cryptocurrency Ecology:

Looking ahead, the future of the cryptocurrency ecology holds tremendous potential. Integration with traditional financial systems is becoming more prevalent, with cryptocurrencies gradually gaining recognition as a legitimate asset class. The emergence of decentralized finance (DeFi) applications is transforming traditional financial services, offering decentralized lending, borrowing, and other innovative solutions. The impact of the cryptocurrency ecology on global economies cannot be ignored, as it challenges traditional financial systems and promotes financial empowerment for individuals worldwide.

Conclusion:

The dynamics of the crypto market are influenced by various factors, including supply and demand dynamics, regulatory environment, investor sentiment, and market volatility. The market attracts a diverse range of participants, including retail and institutional investors, as well as miners and validators. Technology plays a pivotal role, with blockchain, smart contracts, and DeFi transforming financial systems. Understanding market indicators, global impacts, risks, and challenges is crucial for navigating the crypto market effectively. Despite the risks, the crypto market presents opportunities for innovation, financial inclusion, and the reshaping of traditional finance.

FAQs

Q1: Is investing in cryptocurrencies risky?

While investing in cryptocurrencies can be highly profitable, it also carries inherent risks due to market volatility, regulatory uncertainties, and security threats. It is essential to conduct thorough research and understand the risks involved before investing.

Q2: What is the role of institutional investors in the crypto market?

Institutional investors bring increased liquidity, capital, and legitimacy to the crypto market. Their entry into the market has the potential to drive further adoption and growth.

Q3: Can cryptocurrencies replace traditional financial systems?

While cryptocurrencies offer several advantages, it is unlikely that they will completely replace traditional financial systems. However, they can coexist and complement existing systems, providing alternative options and promoting financial inclusivity.

Q4: What are some potential future developments in the crypto market?

Some potential future developments in the crypto market include the integration of cryptocurrencies with traditional financial systems, the rise of decentralized finance (DeFi) applications, the emergence of non-fungible tokens (NFTs), and the development of central bank digital currencies (CBDCs).

Q5: How can individuals protect their investments in the crypto market?

Individuals can protect their investments in the crypto market by adopting security best practices, such as using hardware wallets, enabling two-factor authentication, and being cautious of phishing attempts. Additionally, staying informed about regulatory developments and conducting due diligence on projects can mitigate risks.