Is VOO A Good Investment : Guide (2023)

Investing in the stock market can be an excellent way to grow your wealth over time. However, with countless investment options available, it’s crucial to evaluate the potential of each investment instrument. One such option is VOO, an exchange-traded fund (ETF) that tracks the performance of the S&P 500 index. In this article, we will delve into the factors that determine whether VOO is a good investment and explore its benefits, risks, and expert opinions.

Introduction:

Before we dive into the details, let’s understand what VOO is and how it operates. VOO is an ETF managed by Vanguard, one of the leading investment management companies. It aims to replicate the performance of the S&P 500, which consists of 500 large-cap U.S. stocks. By investing in VOO, you essentially own a diversified portfolio of these stocks.

Understanding VOO:

To comprehend whether VOO is a good investment, it’s crucial to grasp its historical performance and characteristics. VOO has gained popularity due to its low expense ratio, broad market exposure, and liquidity. As an ETF, it provides investors with the opportunity to gain exposure to the U.S. stock market without purchasing individual stocks.

Performance of VOO:

The historical performance of VOO indicates its potential as an investment. Over the long term, the S&P 500 has demonstrated consistent growth, outperforming many other investment options. However, it’s essential to note that past performance does not guarantee future results. Investors should assess various factors to evaluate the potential of VOO.

Vanguard S&P 500 Dividend History and Yields:

| Year/ Dividend Amount | 1st Quarter | 2nd Quarter | 3rd Quarter | 4th Quarter |

|---|---|---|---|---|

| 2013 | — | $0.369 | $0.786 | $0.914 |

| 2014 | $0.779 | $0.809 | $0.876 | $1.026 |

| 2015 | $0.984 | $0.902 | $0.953 | $1.092 |

| 2016 | $1.002 | $0.953 | $0.883 | $1.296 |

| 2017 | $0.998 | $1.01 | $1.176 | $1.184 |

| 2018 | $1.084 | $1.157 | $1.207 | $1.289 |

| 2019 | $1.455 | $1.386 | $1.301 | $1.429 |

| 2020 | $1.178 | $1.433 | $1.309 | $1.383 |

| 2021 | $1.263 | $1.333 | $1.308 | $1.533 |

| 2022 | $1.374 | $1.432 | $1.469 | $1.671 |

| 2023 | $1.487 | — | — | — |

Analyzing the Factors:

Several factors contribute to the overall performance of VOO. These include economic conditions, corporate earnings, geopolitical events, interest rates, and market sentiment. It’s crucial to conduct thorough research and analyze these factors before making an investment decision. By understanding the potential risks and rewards, investors can make informed choices.

Benefits of Investing in VOO:

Investing in VOO offers several advantages. Firstly, it provides diversification across 500 large-cap U.S. stocks, reducing the risk associated with individual stocks. Secondly, VOO offers a low expense ratio, ensuring that a significant portion of the investment is not consumed by fees. Additionally, the liquidity of ETFs allows investors to buy and sell shares throughout the trading day at market prices.

Vanguard S&P 500 ETF (VOO) Overview:

| Expense Ratio (as of 5/10/23) | 0.03% |

|---|---|

| Assets (AUM) | $774.8 billion |

| Number of Holdings | 507 |

| Turnover Rate (as of 12/31/22) | 2.1% |

| SEC Yield (as of 4/11/23) | 1.59% |

| P/E Ratio | 20.1x |

| P/B Ratio | 3.7x |

| Avg. Daily Volume (as of 4/11/23) | 3.97 million shares |

| Inception Date | 09/07/2010 |

| Annualized performance since inception (as of 4/30/23) | 13.30% |

Risks Associated with VOO:

As with any investment, there are risks associated with investing in VOO. The stock market is subject to fluctuations, and the value of VOO shares can go up or down. Investors should be prepared for short-term volatility and have a long-term investment horizon. It’s also essential to consider the impact of market downturns on the value of VOO.

Is VOO a Good Investment?

Determining whether VOO is a good investment depends on various factors, including an individual’s financial goals, risk tolerance, and investment time horizon. Investors seeking broad exposure to the U.S. stock market with a long-term perspective may find VOO suitable. However, it’s important to conduct thorough research and consider personal circumstances before investing. For more understanding, visit this article to get more insight into it.

Top 10 Holdings of the Vanguard S&P 500 ETF (VOO):

| Holdings | Percentage |

|---|---|

| Apple | 6.60% |

| Microsoft | 5.56% |

| Amazon | 2.50% |

| NVIDIA | 1.73% |

| Tesla | 1.65% |

| Berkshire Hathaway Class B | 1.65% |

| Alphabet Class A | 1.61% |

| Alphabet Class C | 1.43% |

| Exxon Mobil | 1.35% |

| UnitedHealth Group | 1.33 % |

Factors to Consider when Evaluating VOO as an Investment:

When evaluating VOO as an investment, it’s crucial to consider the expense ratio, historical performance, underlying index, market conditions, and the overall suitability for one’s investment strategy. Investors should also assess the potential tax implications and consult with a financial advisor if needed.

Expert Opinions on VOO:

Financial experts and analysts have varying opinions on VOO. Some believe that investing in low-cost index funds like VOO is a wise long-term strategy for most investors. They argue that the historical performance and diversification benefits make it an attractive option. However, it’s important to note that opinions may differ, and investors should consider multiple viewpoints.

Tips for Investing in VOO:

If you decide to invest in VOO, here are a few tips to help you make the most of your investment:

- Dollar Cost Averaging: Consider investing a fixed amount regularly to reduce the impact of market volatility.

- Rebalance Periodically: Periodically review your portfolio and rebalance if necessary to maintain your desired asset allocation.

- Long-Term Perspective: Keep a long-term investment horizon in mind to ride out short-term market fluctuations.

- Monitor Market Conditions: Stay informed about economic indicators and market trends that may affect VOO’s performance.

- Consider Dividend Reinvestment: Evaluate the option of reinvesting dividends to maximize long-term growth potential.

Equity Sector Diversification for the Vanguard S&P 500 ETF (VOO):

| Equity Sector | Sector Weighting |

|---|---|

| Information Technology | 27.3% |

| Healthcare | 14.3% |

| Financials | 11.7% |

| Consumer Discretionary | 10.7% |

| Industrials | 8.5% |

| Communication Services | 7.7% |

| Consumer Staples | 6.7% |

| Energy | 4.8% |

| Materials | 2.8% |

| Utilities | 2.8% |

| Real Estate | 2.7% |

Alternatives to VOO:

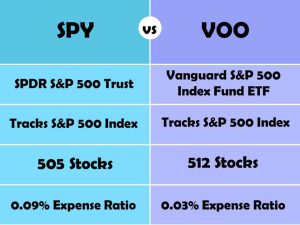

While VOO offers exposure to the S&P 500 index, there are alternative investment options available. Investors may consider other ETFs tracking different indexes, actively managed mutual funds, or individual stock investments. Each option has its own set of advantages and considerations, so it’s crucial to research and compare them based on individual preferences and investment goals.

Conclusion:

In conclusion, whether VOO is a good investment depends on various factors, including an individual’s financial goals, risk tolerance, and investment strategy. VOO offers the potential for broad market exposure, diversification, and low costs. However, investors should conduct thorough research, consider market conditions, and evaluate their own circumstances before making investment decisions.

FAQs

Q1: Can I lose money by investing in VOO?

Yes, investing in VOO carries market risk, and the value of your investment can fluctuate. It’s important to consider the long-term perspective and be prepared for short-term volatility.

Q2: What is the expense ratio of VOO?

VOO has a low expense ratio, typically below 0.05%. This means that a significant portion of your investment is not consumed by fees.

Q3: Is VOO suitable for short-term investments?

VOO is generally considered more suitable for long-term investments due to its focus on broad market exposure and the potential for short-term volatility.

Q4: Can I buy and sell VOO shares throughout the trading day?

Yes, VOO is an ETF, and its shares can be bought and sold throughout the trading day at market prices, providing liquidity to investors.

Q5: Should I consult a financial advisor before investing in VOO?

It’s always a good idea to consult with a financial advisor who can evaluate your personal circumstances, goals, and risk tolerance to provide tailored investment advice.