How To Use Dollar Cost Averaging To Build Long Term Wealth (2023)

Introduction:

Building a successful investment portfolio is a journey that requires careful planning, disciplined execution, and informed decision-making. One powerful tool that can assist you in this process is a dollar cost averaging (DCA) calculator. By incorporating the principles of dollar cost averaging and utilizing a calculator, you can develop a well-rounded portfolio that aligns with your financial goals and risk tolerance. In this comprehensive guide, we will explore the step-by-step process of developing a portfolio using a dollar cost averaging calculator, empowering you to make confident investment decisions.

Understanding Dollar Cost Averaging and Its Benefits:

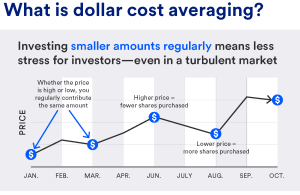

Dollar cost averaging is an investment strategy that involves investing a fixed amount at regular intervals, regardless of market conditions. This approach helps mitigate the impact of market volatility and allows you to accumulate more shares when prices are low and fewer shares when prices are high. The benefits of dollar cost averaging include risk reduction, discipline, and the potential for long-term returns.

Choosing Your Investment Goals and Risk Tolerance:

Before diving into portfolio development, it is essential to define your investment goals and assess your risk tolerance. Determine your financial objectives, whether they are long-term growth, income generation, or a combination of both. Additionally, evaluate your risk tolerance by considering factors such as your time horizon, financial obligations, and comfort level with market fluctuations. Understanding these elements will guide your portfolio construction process.

Identifying Suitable Investment Options:

Research and identify investment options that align with your goals and risk tolerance. This may include stocks, bonds, mutual funds, exchange-traded funds (ETFs), or other asset classes. Consider diversification by investing across different sectors, geographic regions, and asset types to spread risk and capture potential growth opportunities. Thoroughly research each investment option, examining historical performance, fees, and the underlying fundamentals of the investments.

Leveraging a Dollar Cost Averaging Calculator:

Understanding the Calculator:

Familiarize yourself with the features and functionality of a dollar cost averaging calculator. These calculators allow you to input variables such as investment amount, frequency, and duration to determine the potential outcomes of your investment strategy. They provide insights into the average cost per share, total investment amount, and potential returns.

Setting Investment Parameters:

Input your investment parameters into the calculator based on your chosen investment options, goals, and risk tolerance. Consider factors such as the amount you can comfortably invest, the frequency of contributions, and the duration of your investment horizon. The calculator will generate projections and demonstrate the potential growth of your portfolio over time.

Analyzing the Outputs:

Review the outputs generated by the calculator, including projected returns, cumulative investment, and growth trajectory. Analyze how the investment amounts and frequencies impact the overall performance of your portfolio. The calculator outputs provide valuable insights into the potential outcomes of your dollar cost averaging strategy, enabling you to make informed decisions.

Monitoring and Adjusting Your Portfolio:

Regular Review:

Regularly monitor the performance of your portfolio and assess whether it aligns with your investment goals. Review the calculator outputs periodically and compare them with the actual performance of your investments. This review process allows you to make adjustments and ensure that your portfolio remains on track.

Rebalancing:

Over time, the performance of different investments within your portfolio may vary, leading to an imbalance in your asset allocation. Consider rebalancing your portfolio by buying or selling assets to maintain the desired asset allocation. Rebalancing helps manage risk and ensures that your portfolio remains in line with your investment strategy.

Frequently Asked Questions:

Q1: Is dollar cost averaging suitable for all investors?

Dollar cost averaging is a strategy that can be suitable for many investors, especially those with a long-term investment horizon. It is particularly beneficial for individuals who want to mitigate the impact of market volatility and take a disciplined approach to investing. However, it is important to assess your individual financial goals, risk tolerance, and investment time frame before deciding if dollar cost averaging is suitable for you. Consulting with a financial advisor can help you determine if this strategy aligns with your specific circumstances.

Q2: Can I use a dollar cost averaging calculator for different investment options?

Yes, a dollar cost averaging calculator can be used for various investment options, including stocks, bonds, mutual funds, ETFs, and other assets. The calculator allows you to input the relevant parameters for each investment, such as the investment amount, frequency, and duration, and provides projections based on these inputs. By using the calculator for different investment options, you can assess the potential outcomes and make informed decisions about how to allocate your funds across various assets.

Q3: How frequently should I adjust my portfolio based on the calculator outputs?

The frequency of adjusting your portfolio based on the calculator outputs depends on your investment strategy and personal preferences. Generally, it is recommended to review your portfolio periodically, such as annually or semi-annually, to assess its performance and make any necessary adjustments. However, it is important to avoid making frequent changes based on short-term market fluctuations. Dollar cost averaging is a long-term strategy, and consistent contributions over time are key to its success. Regular monitoring and adjustments should be made with a focus on maintaining your desired asset allocation and aligning your portfolio with your long-term investment goals.

Q4: Can I start developing a portfolio with a small investment amount?

Absolutely! One of the advantages of dollar cost averaging is that it allows you to start investing with a small amount of money. You can begin developing your portfolio by consistently investing a fixed amount at regular intervals, regardless of the initial investment size. Over time, as you continue to contribute, your portfolio will grow. It is important to focus on the habit of regular investing rather than the initial investment amount. As your financial situation improves, you can gradually increase your investment contributions to further strengthen your portfolio.

Conclusion:

Developing a robust investment portfolio using a dollar cost averaging calculator is a strategic and rewarding process. By understanding the principles of dollar cost averaging, setting clear investment goals, and leveraging the insights provided by a calculator, you can make informed decisions and optimize your investment journey. Remember to regularly monitor and adjust your portfolio to stay aligned with your goals. Start developing your portfolio today and embark on a path towards long-term financial success.