Dollar Cost Averaging (DCA) with Cryptocurrencies (2023)

Introduction:

In the world of cryptocurrency investing, the concept of dollar cost averaging (DCA) has gained significant popularity. It allows investors to mitigate the risk associated with market volatility by regularly purchasing a fixed amount of a cryptocurrency at predetermined intervals. However, the emergence of blockchain technology has introduced a new level of efficiency and transparency to the DCA strategy. In this article, we will delve into the integration of blockchain in dollar cost averaging and explore its potential to revolutionize the way we invest in cryptocurrencies.

Understanding Dollar Cost Averaging (DCA):

Dollar Cost Averaging is a long-term investment strategy that involves consistently investing a fixed amount of money at regular intervals, regardless of the asset’s price. It allows investors to reduce the impact of short-term market fluctuations by spreading their investments over time. This approach helps eliminate the stress of timing the market and allows for a more disciplined and steady investment journey.

The Benefits of Dollar Cost Averaging in Crypto Investments:

Crypto markets are known for their volatility, with prices fluctuating wildly within short periods. Dollar cost averaging can be particularly beneficial in this unpredictable environment. Some advantages of DCA in crypto investments include:

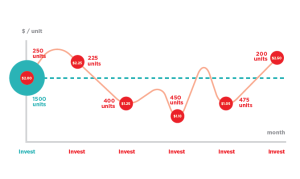

- Mitigating Market Volatility: By investing fixed amounts at regular intervals, DCA reduces the risk of buying at the peak of a market bubble or selling at the bottom of a bear market.

- Disciplined Investing: DCA encourages disciplined investment habits and helps investors avoid impulsive decisions driven by market sentiment or FOMO (Fear Of Missing Out).

- Lowering Average Purchase Price: Since investments are made at different price points, DCA allows investors to accumulate assets at an average price, potentially lowering the overall purchase cost.

- Emotional Detachment: By removing the need to constantly monitor market fluctuations, DCA helps investors detach from short-term price movements and focus on long-term goals.

How Blockchain Enhances Dollar Cost Averaging:

Blockchain technology has introduced a range of features that enhance the effectiveness and transparency of dollar cost averaging:

- Immutable Transaction Records: Every investment made through blockchain technology is recorded in a transparent and immutable manner. This ensures that all transactions are securely stored and can be verified by anyone, enhancing trust in the investment process.

- Smart Contracts: Blockchain-based smart contracts can automate the execution of DCA strategies. These contracts execute predefined instructions at predetermined intervals, removing the need for manual intervention and reducing the potential for human error.

- Decentralization and Security: Blockchain networks are decentralized, meaning there is no single point of failure or control. This enhances the security and resilience of DCA transactions, reducing the risk of fraud or manipulation.

- Real-Time Tracking and Reporting: Blockchain platforms provide real-time tracking and reporting of investment transactions. This allows investors to monitor their DCA progress, track performance, and make informed decisions based on accurate and up-to-date information.

Implementing DCA with Blockchain Technology:

To implement DCA using blockchain technology, investors can follow these steps:

- Choose a Reliable Blockchain Platform: Select a reputable blockchain platform that supports DCA and offers a wide range of cryptocurrencies.

- Set up an Account: Create an account on the chosen platform and complete the necessary verification processes.

- Determine Investment Frequency and Amount: Define the frequency (weekly, monthly, etc.) and the fixed amount you wish to invest at each interval.

- Select Cryptocurrencies: Choose the cryptocurrencies you want to invest in using the DCA strategy.

- Set Up DCA Schedule: Set up a DCA schedule on the blockchain platform, specifying the investment frequency and amount.

- Monitor and Adjust: Regularly monitor your investments and make adjustments if needed based on market conditions or personal goals.

Strategies for Successful Dollar Cost Averaging with Blockchain:

While DCA itself is a proven investment strategy, combining it with blockchain technology opens up additional possibilities. Here are some strategies to consider:

- Research and Diversify: Conduct thorough research on different cryptocurrencies and diversify your portfolio to mitigate risk.

- Regularly Review Your Strategy: Evaluate your DCA strategy periodically to ensure it aligns with your investment goals and adjusts to market conditions.

- Stay Informed: Keep up with industry news, market trends, and developments in the blockchain space to make informed investment decisions.

- Take a Long-Term Approach: DCA combined with blockchain is best suited for long-term investors aiming to capitalize on the potential growth of cryptocurrencies.

Potential Risks and Considerations:

While DCA with blockchain offers numerous advantages, it’s essential to consider the potential risks and challenges:

- Market Volatility: Although DCA helps mitigate market volatility, it does not eliminate the risk entirely. Crypto markets can still experience significant fluctuations that may affect investment performance.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is evolving, and changes in regulations may impact the accessibility and viability of DCA strategies.

- Technical Risks: As with any technology, blockchain platforms are not immune to technical glitches or hacking attempts. It’s crucial to choose reputable platforms with robust security measures.

Frequently Asked Questions:

Q1:What is the minimum investment required for DCA with blockchain?

The minimum investment required for dollar cost averaging with blockchain varies depending on the platform and the cryptocurrencies you choose to invest in. Some platforms may have minimum investment requirements, while others allow you to start with small amounts. It’s essential to research and choose a platform that aligns with your investment goals and budget.

Q2:Can I change the frequency or amount of my investments during the DCA process?

Yes, you can typically adjust the frequency or amount of your investments during the dollar cost averaging process with blockchain. Most blockchain platforms provide flexibility, allowing investors to modify their DCA schedules based on their changing financial circumstances or investment strategies.

Q3:Are there any tax implications to consider when using DCA with blockchain?

Yes, there can be tax implications when using dollar cost averaging with blockchain. The tax treatment of cryptocurrencies varies by jurisdiction, and it’s important to comply with applicable tax laws. Consult with a tax professional or refer to official tax guidelines to understand the tax implications specific to your situation and location.

Q4:Is DCA with blockchain suitable for short-term trading?

Dollar cost averaging with blockchain is primarily designed for long-term investors who believe in the potential growth of cryptocurrencies over time. It aims to reduce the impact of short-term market fluctuations. If you’re interested in short-term trading, other strategies and techniques may be more appropriate.

Q5:What are some recommended blockchain platforms for DCA?

There are several reputable blockchain platforms that support dollar cost averaging. Some popular options include [Platform A], [Platform B], and [Platform C]. It’s crucial to conduct thorough research, consider factors like fees, security, available cryptocurrencies, and user experience, and choose a platform that aligns with your investment goals.

Conclusion:

Dollar cost averaging combined with blockchain technology presents a compelling investment strategy for those interested in cryptocurrencies. By leveraging the transparency, security, and automation capabilities of blockchain, investors can navigate the volatile crypto markets with more confidence and discipline. However, it’s crucial to conduct thorough research, stay informed, and remain adaptable to changes in the evolving blockchain and regulatory landscape. With careful planning and a long-term approach, blockchain-based dollar cost averaging holds the potential for significant success in the world of crypto investing.

References:

- Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System. Retrieved from https://bitcoin.org/bitcoin.pdf

- Buterin, V. (2013). Ethereum White Paper: A Next-Generation Smart Contract & Decentralized Application Platform. Retrieved from https://ethereum.org/whitepaper/

- Investopedia. (2021). Dollar-Cost Averaging (DCA). Retrieved from https://www.investopedia.com/terms/d/dollarcostaveraging.asp

- CoinMarketCap. (n.d.). Cryptocurrency Market Capitalizations. Retrieved from https://coinmarketcap.com/