How Does Dollar Cost Averaging Calculator Work?

Introduction:

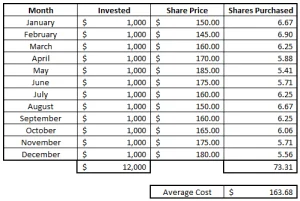

Dollar cost averaging (DCA) is a proven investment strategy that involves investing a fixed amount of money at regular intervals, regardless of market conditions. To maximize the benefits of dollar cost averaging, investors can utilize a calculator to determine the optimal investment amounts and intervals. In this comprehensive guide, we will explore the required inputs for a dollar cost averaging calculator, enabling you to make informed investment decisions and potentially achieve long-term financial goals.

Understanding Dollar Cost Averaging

Before diving into the required inputs for a dollar cost averaging calculator, let’s briefly recap the concept of dollar cost averaging. DCA involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This approach allows investors to buy more shares when prices are low and fewer shares when prices are high, potentially reducing the impact of market volatility.

Key Inputs for a Dollar Cost Averaging Calculator

- Initial Investment Amount: The initial investment amount represents the sum of money you plan to invest in the chosen asset or investment vehicle to kickstart your dollar cost averaging strategy. It is the starting point from which your subsequent investments will be calculated.

- Regular Investment Amount: This refers to the fixed amount of money you plan to invest at each interval. It should be an amount that fits your financial capabilities and aligns with your investment goals. The regular investment amount should be consistent throughout the duration of your dollar cost averaging strategy.

- Investment Frequency: The investment frequency determines how often you will invest the fixed amount. Common options include daily, weekly, bi-weekly, monthly, or quarterly intervals. The frequency should be chosen based on your financial situation and the level of involvement you desire in your investment strategy.

- Investment Duration: The investment duration is the length of time you plan to continue your dollar cost averaging strategy. It could be several months, years, or even decades, depending on your financial goals and investment horizon. The longer the duration, the greater the potential for compounding growth.

Additional Considerations for a Dollar Cost Averaging Calculator

- Asset Selection: Determine the specific asset or investment vehicle you intend to invest in. It could be stocks, exchange-traded funds (ETFs), mutual funds, or other assets. Each asset may have different historical returns, risk profiles, and growth potential. Thorough research and consideration of your investment objectives are crucial in selecting the right asset for your dollar cost averaging strategy.

- Return Expectations: While dollar cost averaging aims to mitigate market timing risks, it is essential to have realistic return expectations. Historical performance, market conditions, and economic factors can provide insights into potential returns, but it is important to acknowledge that past performance does not guarantee future results.

- Monitoring and Adjustments: Regularly review your dollar cost averaging strategy and make adjustments if necessary. Changes in personal circumstances, market conditions, or investment goals may warrant modifications to your investment amount, frequency, or asset allocation.

Frequently Asked Questions

Q1: Are dollar cost averaging calculators accurate in predicting investment outcomes?

Dollar cost averaging calculators provide estimates based on the inputs provided. While they can provide useful insights and projections, they do not guarantee investment outcomes. Actual results may vary due to market fluctuations and other factors.

Q2: Can dollar cost averaging calculators be used for any asset class?

Yes, dollar cost averaging calculators can be used for various asset classes, including stocks, bonds, cryptocurrencies, and more. However, the specific calculator may vary depending on the asset class and investment platform.

Q3: Is it necessary to use a dollar cost averaging calculator, or can I manually calculate my investments?

While manual calculations are possible, using a dollar cost averaging calculator simplifies the process and provides accurate projections. These calculators save time and ensure consistency in your investment strategy.

Conclusion:

Utilizing a dollar cost averaging calculator can significantly enhance your investment strategy by providing valuable insights into investment amounts, frequencies, and durations. By understanding the required inputs and carefully considering factors such as asset selection and return expectations, you can optimize your dollar cost averaging approach. Remember that a calculator is a tool, and it is essential to regularly review and adapt your strategy based on changing circumstances and investment goals.

References:

- Investopedia: Dollar-Cost Averaging (https://www.investopedia.com/terms/d/dollarcostaveraging.asp)

- Seeking Alpha: https://seekingalpha.com/article/4451274-dollar-cost-averaging